Income Tax Compliance Calendar April 2026 Finest Magnificent. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under.

Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various.

Source: oscarplazarus.pages.dev

Source: oscarplazarus.pages.dev

Tax Compliance Calendar 202526 Irs Oscar Lazarus A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under.

Source: financepost.in

Source: financepost.in

Tax Compliance Calendar FinancePost Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

Source: calendar.udlvirtual.edu.pe

Source: calendar.udlvirtual.edu.pe

April 2024 Compliance Calendar 2025 CALENDAR PRINTABLE Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under. In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various.

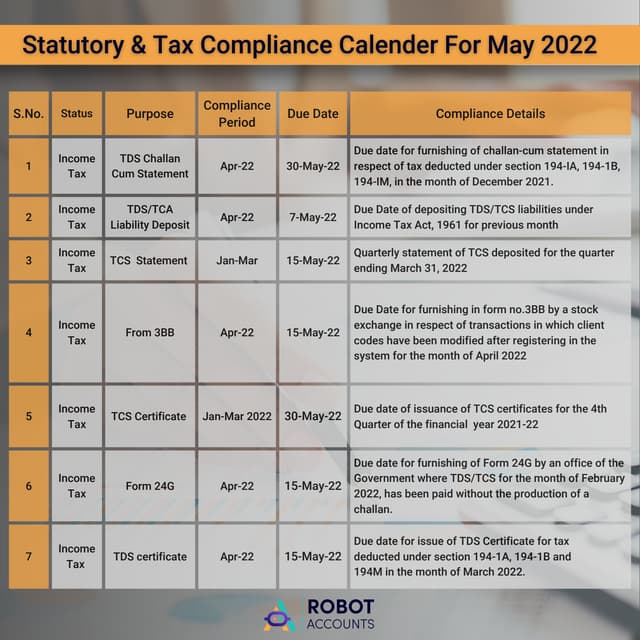

Source: www.taxscan.in

Source: www.taxscan.in

Tax, GST Compliance Calendar 2025 Deadlines and Filing Dates A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under.

Source: ginajreedyj.pages.dev

Source: ginajreedyj.pages.dev

Tax Calendar Fy 202526 Ibby Kimmie In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various. Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under.

Source: taxupdates.cagurujiclasses.com

Source: taxupdates.cagurujiclasses.com

Tax and GST Compliance Calendar April 2025 In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

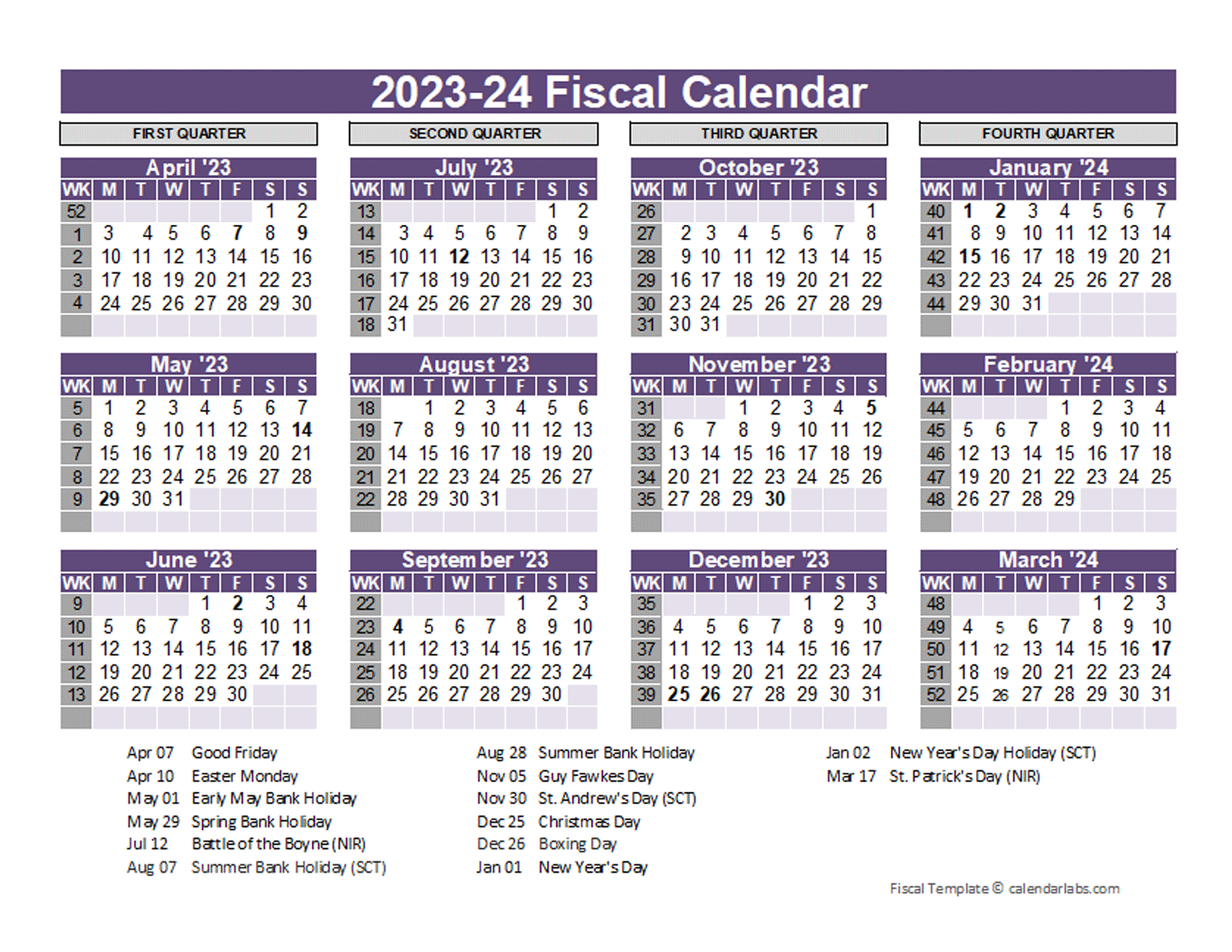

Source: www.calendarpedia.co.uk

Source: www.calendarpedia.co.uk

Financial calendars 2026/27 UK in Microsoft Word format A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various.

Source: kieraellis.pages.dev

Source: kieraellis.pages.dev

Get Ahead of the Curve Preparing for the Major Tax Changes of 2026 Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under. In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various.

Source: oscarplazarus.pages.dev

Source: oscarplazarus.pages.dev

Tax Compliance Calendar 202526 Irs Oscar Lazarus In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various. Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under.

Source: winniywinonah.pages.dev

Source: winniywinonah.pages.dev

Tax Compliance Calendar April 2025 Afton Alethea Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

Source: lusaazjacklyn.pages.dev

Source: lusaazjacklyn.pages.dev

Gst Compliance Calendar 2025 26 Pavia Beverlee In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

Source: katheasesilvia.pages.dev

Source: katheasesilvia.pages.dev

Statutory Compliance Calendar 202526 Texas Ashley Terrie A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Due date for deposit of tds for the period april 2025 to june 2025 when assessing officer has permitted quarterly deposit of tds under.